Introduction

The UK housing market has been facing notable changes recently, with house prices experiencing a steady decline. For buyers, sellers, and investors, understanding the reasons behind this downturn is crucial for making informed decisions.

This article will provide a comprehensive look at the UK House Prices Fall, the factors influencing this trend, and what it means for different players in the market.

Why Are UK House Prices Falling?

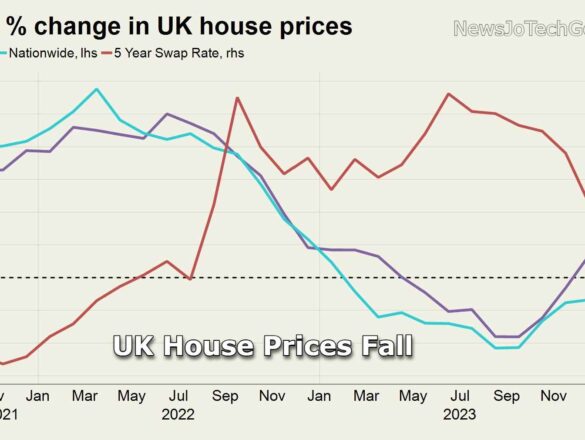

Several economic factors are contributing to the decline in UK house prices. Rising interest rates, inflation, and general economic uncertainty are some of the main reasons.

As borrowing becomes more expensive, fewer buyers can afford to purchase homes, which in turn causes demand to drop.

This decrease in demand leads to a reduction in house prices, as sellers adjust their expectations to attract potential buyers.

The Role of Inflation and the Cost of Living Crisis

The ongoing inflation crisis and the increased cost of living have left many UK households struggling financially. People are prioritizing their day-to-day expenses, leaving little room for the high costs associated with homeownership.

As a result, fewer people are entering the property market, which has further contributed to the fall in house prices. The combination of economic challenges and reduced consumer spending power has created a perfect storm for the property market.

How Rising Mortgage Rates Are Affecting the Housing Market

The Bank of England’s decision to raise interest rates in response to inflation has had a significant impact on the housing market.

With higher mortgage rates, potential buyers face higher monthly repayments, making it harder for them to afford the homes they want.

As a result, the demand for housing decreases, putting downward pressure on prices. Many homeowners also struggle to afford the increased cost of borrowing, further contributing to the market slowdown.

Will UK House Prices Continue to Fall in 2025?

While it’s difficult to predict exactly what will happen to UK house prices Fall, experts believe that there could still be a further decline in 2025. Economic uncertainty, the ongoing cost of living crisis, and continued high mortgage rates may continue to suppress demand.

However, some analysts suggest that the market could stabilize once inflation decreases and interest rates level off. For now, the market remains unpredictable, and potential buyers and sellers need to be prepared for continued volatility.

How Is the Fall in House Prices Affecting Buyers?

For buyers, the fall in UK house prices could seem like an opportunity to enter the market at a lower cost. However, rising mortgage rates make it harder to afford homes, especially for first-time buyers who may struggle with higher monthly repayments.

While prices may be lower, the overall affordability of properties is still a major concern. Buyers need to carefully consider the long-term financial implications of purchasing a home in this environment.

What Does the Fall in House Prices Mean for Sellers?

Sellers in the current market face a challenging situation. With house prices falling, sellers may be forced to lower their expectations and reduce the asking price of their property to attract buyers.

Those who purchased homes at a higher price in recent years may find themselves in a position where they cannot sell for a profit. This shift in the market has made it more important than ever for sellers to be realistic about their property’s value and timing.

The Impact on Property Investors in the UK

For property investors, the fall in house prices presents both risks and opportunities. On the one hand, lower property prices may provide a chance to purchase additional properties at a discount.

On the other hand, rising mortgage rates and reduced tenant affordability could reduce rental demand and rental yields.

Additionally, some investors may struggle to refinance properties due to higher borrowing costs. Investors should carefully evaluate their financial position and long-term plans before making any major moves in the current market.

How the Rental Market Is Responding to Falling House Prices

While house prices are falling, the rental market is showing signs of growth. With fewer people able to buy homes, more individuals are turning to the rental market for housing.

This increased demand for rental properties is driving up rental prices in many areas. Landlords may see higher rental income as demand increases, but they should also be aware of rising tenant affordability issues.

Renters should expect higher rents, especially in urban areas or regions with strong job markets.

Which Regions in the UK Are Seeing the Biggest Declines in House Prices?

The fall in UK house prices is not uniform across the country. Certain regions are experiencing more significant declines than others.

London and the South East have seen some of the sharpest drops, as housing markets in these areas had previously been overheated.

In contrast, areas in the North of England, such as Manchester, Liverpool, and Newcastle, are seeing less dramatic falls, with some regions even experiencing slight price increases due to strong local economies. Buyers and sellers should pay attention to regional trends when making decisions.

How to Navigate the Housing Market During a Downturn

For those buying or selling in a market where house prices are falling, it’s crucial to approach the situation carefully. Buyers should focus on affordability, taking into account not just property prices but also the long-term cost of borrowing.

Sellers should adjust their expectations and be open to negotiating prices. Both parties should remain patient and avoid making hasty decisions. Working with experienced real estate agents and financial advisors can provide valuable guidance in uncertain times.

Are There Any Government Measures to Stabilize the Housing Market?

The UK government has historically introduced various measures to help stabilize the housing market during times of downturn. These measures may include changes in stamp duty, first-time buyer schemes, or temporary support for mortgage lenders.

However, the effectiveness of such measures remains uncertain, especially given the broader economic challenges the country is facing. Homebuyers and sellers should stay informed about any new government interventions that may impact the housing market.

How to Find Good Deals in a Falling Market

Despite falling house prices, there are still opportunities for buyers to find good deals. Patience is key. Buyers should consider areas where demand is lower, but long-term growth potential remains strong.

Auctions, distressed sales, and properties that have been on the market for a while could present opportunities for lower-priced properties. By conducting thorough research and acting strategically, buyers can take advantage of the current market conditions.

The Role of Supply and Demand in the Falling House Price Trend

A major factor driving the fall in UK house prices is the imbalance between supply and demand. Fewer buyers are entering the market, while the supply of homes remains relatively steady.

This excess of supply over demand puts downward pressure on prices. As economic conditions change, it’s possible that demand may pick up, helping to stabilize prices in the future.

Buyers and sellers should closely monitor supply and demand dynamics in their local markets.

Conclusion

In summary, UK house prices are falling due to a combination of rising interest rates, inflation, and reduced consumer confidence.

While the market presents challenges for both buyers and sellers, there are still opportunities to be found. Buyers may find lower prices, but must carefully consider mortgage rates and overall affordability.

Sellers may need to adjust their expectations and be patient in the face of a slower market. Regardless of your role, staying informed and making well-considered decisions will help you navigate the uncertainties in the UK housing market.