Cash discount merchant services offer a unique opportunity for businesses to manage transaction fees creatively. By implementing a cash discount program, merchants can encourage customers to pay with cash, thus saving on credit card processing fees. This not only reduces overhead costs but can also enhance customer loyalty by providing financial incentives.

Many businesses are now recognizing the benefits associated with these services, particularly in a landscape where every dollar saved counts. Cash discount programs allow merchants to pass savings onto consumers while maintaining competitive pricing. By highlighting the advantages, shops can attract a customer base that appreciates lower prices when paying with cash.

As cash discounting gains traction, understanding its mechanics becomes essential for any business looking to improve their bottom line. Examining how these programs work will provide insights into their implementation and potential impacts on customer relationships and financial health.

Understanding Cash Discount Merchant Services

Cash discount merchant services provide businesses with an alternative approach to managing credit card fees through strategically offering discounts for cash payments. This model not only incentivizes customers to pay in cash but also helps businesses lower their overall transaction costs.

Definition and Mechanics of Cash Discounts

Cash discount programs involve offering customers a reduced price for transactions made with cash instead of credit or debit cards. Merchants display a standard price alongside a discounted cash price. For example, a product priced at $100 may cost $95 when paid in cash.

The merchant absorbs the transaction fees associated with card payments. By encouraging cash transactions, merchants can effectively lower the fees charged by credit card companies, resulting in increased profit margins.

Implementation typically includes clear signage at the point of sale. Businesses must ensure compliance with local laws regarding pricing and promotional practices. Educating staff about the program is vital for consistent communication with customers.

Benefits for Merchants

Adopting cash discount merchant services can yield significant savings. Here are the key benefits:

- Reduced Transaction Costs: Lower fees are incurred as cash transactions eliminate credit card processing fees.

- Improved Cash Flow: Receiving cash immediately can enhance liquidity for daily operations.

- Competitive Pricing: Merchants can offer better prices to incentivize cash payments without decreasing overall revenue.

This model can differentiate businesses from competitors and attract price-sensitive customers looking to save money. Merchants also gain potential national branding opportunities by joining networks of businesses that implement similar programs.

Consumer Perspectives

From a consumer standpoint, cash discount programs can be appealing. Customers often appreciate the opportunity to save money by paying with cash.

However, some may be hesitant due to the transition from cash to digital payment methods. Many consumers prefer credit cards for safety and rewards.

Transparency is essential; customers must clearly understand the cash discount offered. Businesses can enhance this experience by clearly communicating the value of cash payments, which can increase customer retention and satisfaction.

Implementing Cash Discount Programs

Cash discount programs offer a strategic way for businesses to reduce credit card processing fees while incentivizing customers to pay in cash. Implementing these programs requires careful planning, technology integration, and clear communication with both staff and customers.

Legal Considerations

Before launching a cash discount program, businesses must understand legal requirements. Merchant services must comply with federal and state regulations. Some states have specific laws regarding surcharging and discounting practices that need to be adhered to.

It is essential to consult legal resources or professionals to ensure compliance. A business should prepare to document the cash discount policy. Transparency in terms will help avoid potential legal issues. Keeping all necessary documentation and records is vital for demonstrating compliance if issues arise.

Setting Up a Cash Discount Program

Establishing a cash discount program involves a few key steps. First, a business must decide on the discount percentage, often between 2-5%. It’s crucial to ensure the discount is appealing yet financially viable.

Next, businesses should inform customers about the program clearly. This can involve signage, point-of-sale messaging, and online communication. Implementing clear terms and conditions can prevent confusion. It is also beneficial to evaluate the business’s pricing structure to accommodate the change effectively.

Technology and Payment Processing Solutions

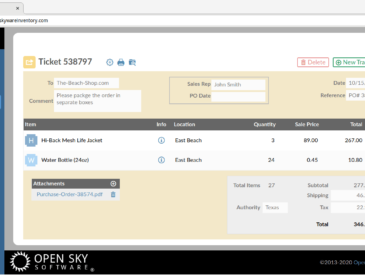

Integrating technology is vital for a successful cash discount program. Businesses need a payment processing solution that supports cash discounts. It is helpful to work with providers experienced in cash discount implementations.

Some point-of-sale systems allow for easy integration of cash discounts directly at checkout. These systems can automate the adjustment for cash transactions without manual intervention. Choosing the right technology will simplify the customer experience and ensure accurate calculations.

Staff Training and Customer Communication

Proper training for staff is essential for effective program implementation. Staff should be well-versed in the cash discount policy and its benefits. Regular training sessions can help staff confidently explain the program to customers.

Establishing effective communication with customers is equally important. Clear and engaging messaging can be displayed prominently around the store and on receipts. Encouraging staff to initiate conversations with customers regarding the program can help foster understanding and acceptance. Providing FAQs or handouts may also assist in addressing common queries.